FOREVER FREE SOLUTIONS

BUILD THE CREDIT. SECURE THE FUNDING.

You Deserve!

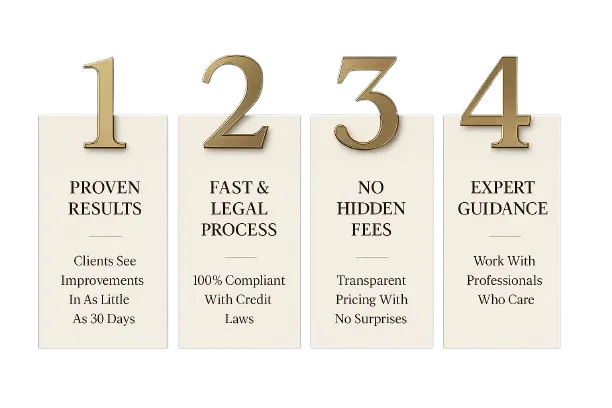

WHY CHOOSE FOREVER FREE SOLUTIONS?

PRICING PLANS

Choose Your Path to Financial Power

PERSONAL CREDIT REPAIR PLAN

$199/month

Get expert help to restore, rebuild, and protect your credit.

✔ Full Credit Analysis

✔ Unlimited Monthly Disputes

✔ Credit Monitoring Guidance

✔ Custom Action Plan

✔ Email & Chat Support

✔ Educational Resources

💼 CREDIT REPAIR BUSINESS LAUNCH KIT

$597/month

Launch your own credit repair business using our automated, done-for-you system.

✔ A re-brandable & Credit Repair Website Template

✔ Automated Client Portal (Clients can track progress in real-time)

✔ Pre-Built Marketing Funnel (Lead capture, automated follow-up)

✔ Lead Capture System

✔ Done-For-You Legal Docs (Client agreement templates, disclosures)

✔ Booking Calendar & SMS/Email Follow-ups

✔Onboarding & Training (Step-by-step tutorials)

✔Live Support (Business hours chat & ticket support)

✔ Rebrandable + No Coding Needed

✔ Access to Training Portal & Support

What's Included in Credit Repair CRM — $179/mo

Dispute Letter Automation (Send & track disputes with 1 click)

Credit Report Importing (Integrates with major credit bureaus)

Client Management Dashboard (Track progress, deadlines, & tasks)

Billing & Payment Processing

Secure Document Storage

SMS & Email Notifications (Automatic client updates)

Performance Analytics (Business & client progress reports)

💼 Plug-and-Play Business Total

Business Setup — $420/mo

Credit Repair CRM — $179/mo

✔ No tech skills needed — everything is set up for you

✔ Recurring monthly income potential from each client

✔ Full control of pricing and profit margins

✔ No tech skills needed — everything is set up for you

✔ Recurring monthly income potential from each client

✔ Full control of pricing and profit margins

CHOOSE YOUR PATH TO FREEDOM

Pick the level that matches where you are — we’ll meet you there and move you forward.

The Foundation-

Credit Repair

$127.99/month

$249 One-Time Enrollmet/Audit Fee+

Personal credit audit & customized dispute strategy — a detailed breakdown of your reports with a step-by-step plan tailored to your situation.

Unlimited challenges with all three credit bureaus — we don’t stop until every item is addressed.

24/7 client portal access — track your disputes, updates, and results anytime.

Guidance on rebuilding & maintaining strong credit — which accounts to add, how to manage utilization, and what to avoid.

Basic analytics & insights — monthly reporting so you can see measurable progress.

Ongoing monthly disputes & support until goals are met — consistent rounds that keep pressure on the bureaus.

Score-boosting roadmap — recommendations to raise limits, add mix, and optimize credit utilization.

Education & resources — simple guides that show you how credit really works (so you never fall back).

Dedicated client support — real people you can reach for answers when you need them.

👉 Get Start today and take the first step toward restoring your financial future.

The Structure-

Business Blueprint

$597.99

Full review of your credit report — identify errors and funding barriers before they cost you approvals.

Fundable business setup guidance — LLC/EIN, banking, compliance, and structure designed to pass lender checks.

Lender-safe positioning — NAICS/MCC best practices to keep you out of high-risk categories.

Professional presence setup — domain email, business phone, and Google Business profile checklist.

Qualifying strategies — proven steps to unlock high-limit credit cards, lines of credit, and loans.

Funding insights for 2025 & beyond — what lenders are prioritizing right now.

Custom coaching calls — 1-on-1 sessions tailored to your exact credit and business goals. Step by Step walk through.

Scaling strategy — how to grow from small approvals into sustainable business credit.

Business credit roadmap — vendor → revolving → lines of credit with reporting cadence.

Ongoing coaching & accountability — structured check-ins to keep you on track.

Priority support — get your questions answered quickly so you can move forward with confidence.

👉 Get started today and take the first step toward restoring your financial future.

The Empire-

Business Funding Solutions

Custom Funding Programs — Based on Eligibility

Pre-qualification assessment — see where you stand with no impact on your personal credit.

Access to multiple funding options — banks, credit unions, and fintech lenders tailored to your profile.

Strategic guidance on credit requirements — know exactly what lenders expect before you apply.

Conditional redirection — we point you to the lenders and products that best fit your profile.

Expert support through the funding process — from applications to approvals, you’re not alone.

Application sequencing strategy — apply in the right order to maximize approvals and limits.

Capital stacking roadmap — how to combine approvals into 5–6 figures of usable funding.

Reconsideration & appeal scripts — what to say if you get denied or offered less than expected.

Exclusive lender updates — insider knowledge on which banks and fintechs are lending right now.

👉We’ve partnered with a trusted provider to help match you with tailored funding opportunities. Click below to check your eligibility instantly

PREMIUM SERVICES

Discover Our Credit Repair and Restoration Works